₹20 is the minimum earnings required for withdrawal

- Home

- Retailers

- Price History

- Deals

Categories Brands

Categories Brands- Kids

- Toys

- Cycle

- Study table

- Tent house

- Dresses for Girls

- Shirts for Boys

- T-Shirts for Girls

- T-Shirts for Boys

- Shoes for Girls

- Shoes for Boys

-

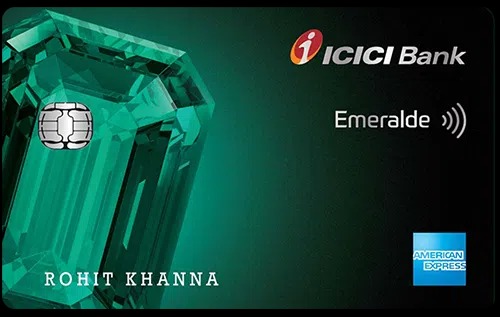

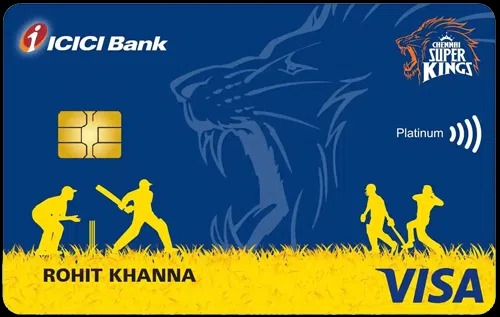

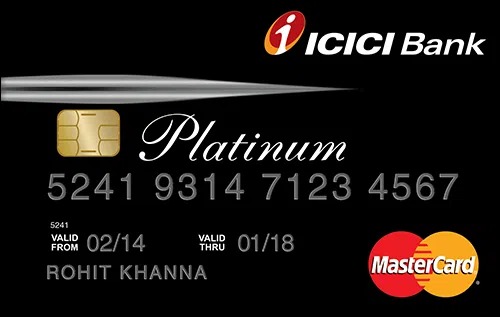

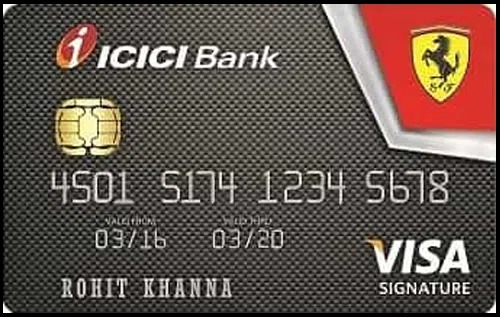

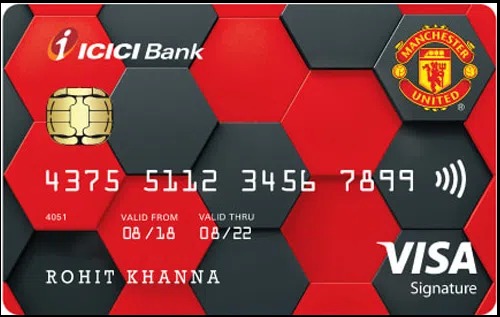

Credit cards

- Card Categories

- Lifetime Free

- Food

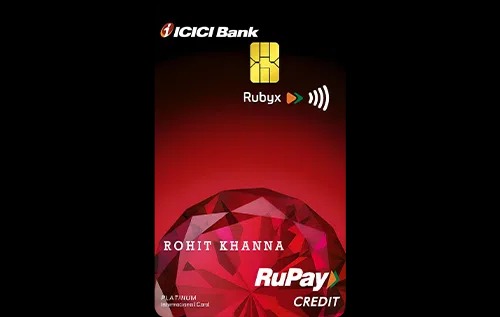

- RuPay Credit Cards

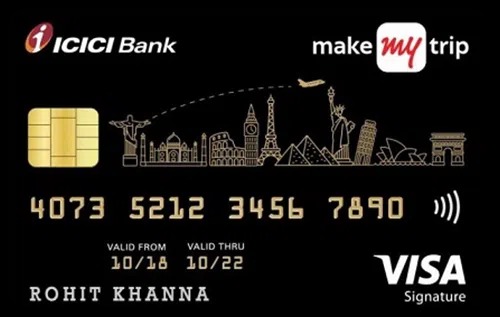

- Travel Credit Cards

- Rewards

- Cashback

- Fuel

- Forex Credit Cards

- Domestic Lounge

- Shopping

- New age cards

- Jupiter

- OneCard

- Gild Credit Card

- Scapia Credit Card

- Bajaj Finserv Binge

- SBI Simplyclick

- Free Money

- Today's Word

- Influencer Club

- Direct Links